The Georgia Tech Research Corporation (GTRC) accepts and manages all corporate and foundation monetary gifts specifically designated for the support of research. Gifts outside of this category are accepted and managed by the Georgia Tech Foundation. GTRC does not support GT France or GT China operations.

Gifts in support of research include:

- Support for research in a designated subject matter area issued to a specific faculty member, lab, or center.

Gifts in support of research do not include:

- Establishment of a new endowment or a gift to an existing endowment

- Student-focused design projects and competitions (e.g. Capstone Design*)

- Multidisciplinary student project teams (e.g., the Vertically Integrated Projects (VIP) Program)

- Student networking and recruitment efforts (e.g., Corporate Affiliates Program (CAP))

- Extracurricular student-focused efforts, including innovation and entrepreneurship (e.g. Create-X, Inventure Prize)

- Prizes, awards, or “bounties” in recognition of student efforts (e.g. XPrize)

- Faculty member or unit/center effort that is only tied to supporting the faculty member or entity, and does not require that the funds be specifically used for research

- Scholarships and fellowships of students, whether graduate or undergraduate

- Sponsorship of an event, conference, poster session or symposium

- Support for professorships and endowed chairs

- Sponsorship of travel support (faculty, staff, or student)

- Corporate gifts that are not restricted to research, even if they are for a research-focused center, institute, or other specific entity at Georgia Tech

- Corporate gifts to a unit or department

- Any gift from an individual

*Occasionally capstone funds will be processed by GTRC at the request of an industry sponsor who wants to utilize their master research agreement for this purpose. In this scenario, capstone projects meet the definition of sponsored awards and therefore the funding would not be processed as a gift.

Note that a mention of the word “research” does not necessarily dictate that a gift must be processed through GTRC; if gift funds are not in support of research, as defined, then GTF may process the gift under terms consistent with those acknowledged in the Professor Gift Acceptance Agreement.

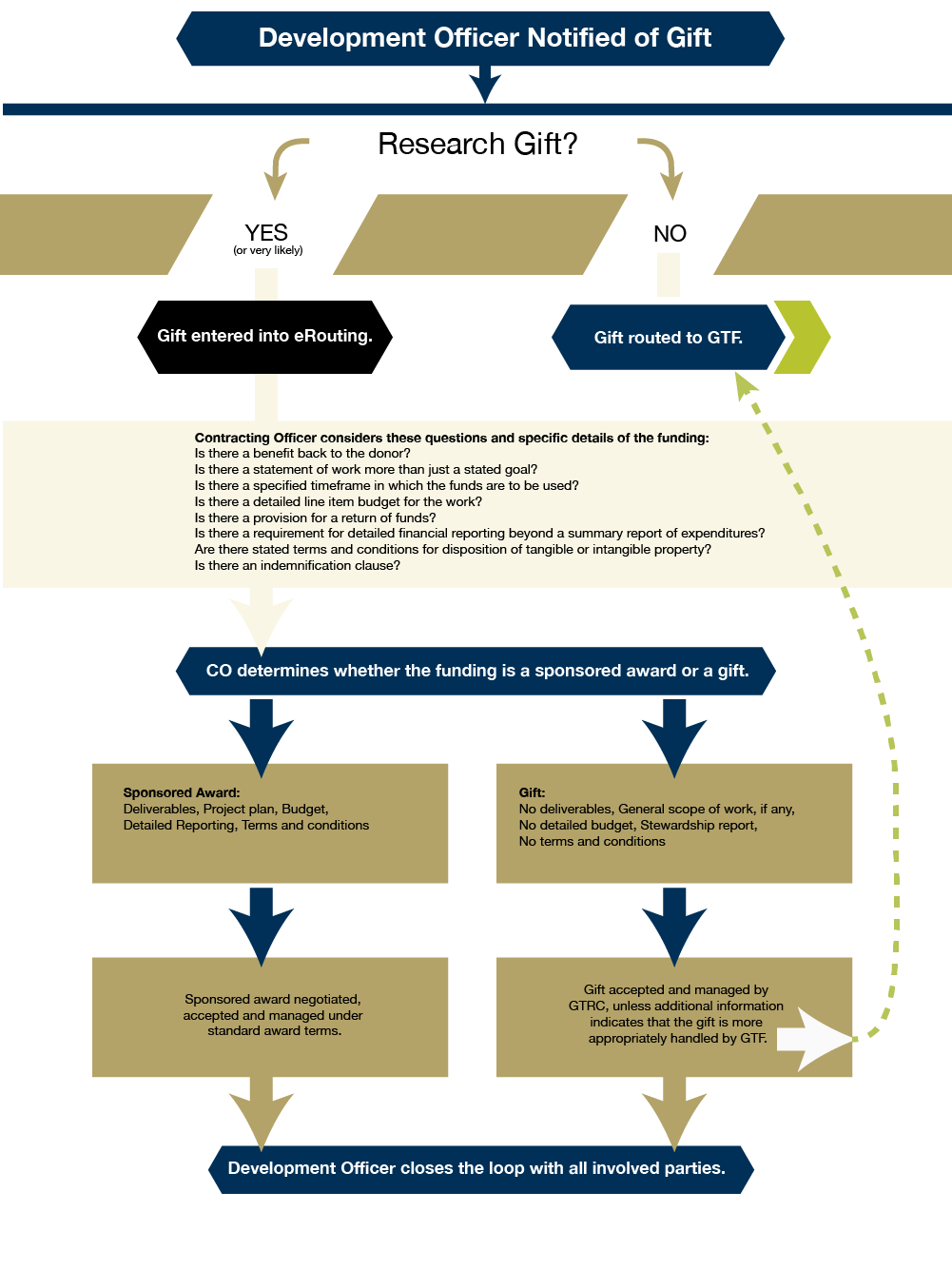

The Unit Development officer and/or the Institute’s Relationship Manager for the corporation or foundation is the “steward ” of any research gift and should manage the process for the faculty member, in coordination with a departmental research administrator.

- If the corporate or foundation gift is for research, the Principal Investigator and or unit grants manager enter the information in e-routing (detailed instructions below)

- If the corporate or foundation gift is not for research, the Unit Development Officer and/or Institute’s Relationship Manager work with the unit’s accounting office and complete a gift transmittal form, include all information related to the gift, and send it to GTF.

Throughout the process, the Unit Development Officer and /or Institute Relationship Manager will report back to the PI and will serve as the PI’s primary point of contact.

Gifts in Support of Research vs. Sponsored Awards

Gifts are distinct from sponsored awards. Contracting officers are trained to recognize this distinction and can advise faculty and departmental administrators as to how funding should be categorized. Should the contracting officer need additional guidance on a given situation, they will consult the Vice President of Research Administration, and if necessary, outside counsel.

Processing Fee on Research Gifts

By law, Georgia Tech and GTRC are strictly prohibited from charging the additional costs associated with the administration of research gifts to the Institute’s Facilities and Administrative (F&A) reimbursements, which is how all other support services in GTRC are funded. Therefore, GTRC collects a processing fee of 5% on all research gifts.

Process for Administration of Corporate Research Gifts to GTRC

- The PI/PD (requestor) or their delegate must submit requests for GTRC Corporate Research Gifts in eRouting.

- The requestor must use the naming convention GIFT: “GIFT: (details as applicable), I.e. “GIFT: Research funding in the area of Latency-centric Resource Management” or “GIFT: Google Faculty Award.”

- The requestor must select “Research Gift” as the type of proposal.

- The requestor must upload, when available:

- Copy of proposal and/or any other documentation sent to donor in which the potential use of funds has been addressed.

- Copy of solicitation/notice of opportunity and/or any documentation received from donor.

- Copy of statement of work if applicable (otherwise a dummy document titled “Not a condition of this gift” may be used).

- Copy of transmittal/gift letter, if received. Typically, donor should not issue check and gift letter until after Research Administration has reviewed all documentation uploaded in E-Routing (items a., b., and c.) and Research Integrity Assurance has completed all necessary compliance reviews.

- The total amount of the gift (this should serve as the “budget” unless a budget document already exists).

- If requestor receives a check it should be forwarded directly to GTRC Accounting along with a transmittal/gift letter.

- Requestor must also answer all compliance questions (human subjects, animal use, export control, conflict of interest, etc.) within eRouting.

- Based upon sponsor selected by unit requestor, eRouting will route the request to the appropriate Contracting Officer in Research Administration. The Contracting Officer will review the request and determine whether funds should be accounted for as a gift or a sponsored award. Should the contracting officer need additional guidance on a given situation, they will consult the VP for Research Administration, and if necessary, outside counsel.

- If determined to be a sponsored award, additional information is required and the proposal will be administered and accounted for consistent with all other sponsored awards. The Contracting Officer will return the proposal to the requestor for the required additional information, so the award routing can be corrected to reflect the correct category and additional info can be provided.

- If determined to be a research gift and any compliance questions are checked “yes,” the Contracting Officer will need to reach out to the appropriate department within the Office of Research Integrity Assurance as prompted within eRouting.

- If determined to be a non-research gift that is more appropriate for routing through the Georgia Tech Foundation (GTF), the Contracting Officer will work with GTF and the development officer to ensure concurrence with this analysis and then relay the relevant next steps to the requestor.

- The default period of performance for research gifts will be seven years from either the date the letter was issued, or, if there is a mutually executed agreement, the date of last signature. The period of performance may be extended upon written request to the Contracting Officer at the end of the seven-year term. After the period of performance, unused gift funds will be accounted for as fixed-priced residuals.

- Appropriate departments within Research Integrity Assurance will complete all necessary compliance reviews.

- Once all required compliance reviews and signature process are complete, the Contracting Officer will then accept the proposal within eRouting. This pushes the proposal to GTRC accounting's queue where it will await payment confirmation from GTRC accounting. The Contracting Officer will also scan and upload into eRouting any additional documentation created or received regarding the gift.

- After routing, the CO will communicate directly with the sponsor, either copying the development officer or providing them with timely updates.

- After receipt of a check, GTRC Accounting will mark the gift as complete and forward the request to the Contracting Officer who will enter the net funding (total funding minus the administrative fee) into the Contract Information System (CIS) under the award type “Research Gift.”

- GTRC will recognize the total amount received in the GTRC revenues and in the official tax receipt sent to the donor.

- CIS will push the net amount to Workday. Grants and Contracts Accounting will then create a “Research Gift” Award in Workday using the information in the Contract Information System.

FAQs

Will gifts be charged F&A?

Not unless the gift letter specifically allows it. However, a 5% processing fee will be collected from all gifts as of July 1, 2021.

Why is GTRC collecting a fee for gift processing if GTF does not?

The Georgia Tech Foundation has a different budget model than both GTRC and Georgia Tech. GTF has the ability to cover their administrative costs through fees charged for the management of endowment funds. By law, Georgia Tech and GTRC are strictly prohibited from charging the additional costs associated with the administration of these monetary gifts to the Institute’s Facilities and Administrative (F&A) reimbursements, which is how all other support services in GTRC are funded.

My donor does not allow administrative fees of any kind to be charged to a gift. What do I do?

Work with your development officer to communicate the nature of the fee to the donor. Research gift donor funds may have a general-purpose, but not explicit budget allocations. Therefore, limits on how Georgia Tech uses these funds should not be imposed by a donor.

My donor allows administrative fees at a higher percentage than our standard 5%. Will GTRC collect the maximum or only the 5%?

The maximum. 5% is a processing fee; if the gift is going to be spent on research, then the remainder will be applied to a portion of the F&A costs generated by the research expenditures.

May I direct a portion of my gift to work at another institution?

No. Subawards are not permissible under research gifts.

Please provide some examples of some popular programs that may constitute either gifts or sponsored awards.

As an institution, we do our best to negotiate the terms of any funding for our faculty to allow the widest possible flexibility. However, there are instances where the terms of corporate funding conflict with either our mission as a university or our obligations to the state of Georgia. Please note that funding characterized as gifts from some of the companies below may involve more complex negotiations and may therefore take extra time to complete:

- Amazon

- Intel

In rare cases, we may be unable to accept funding through certain avenues. Faculty should initiate conversations with their development officers early in the process in order to understand and anticipate potential hurdles, particularly in situations where funding is characterized as a gift but involves an application process.

What are some common elements that may preclude funding from being classified as a gift?

- Explicit or implicit references to collaboration between donor and the relevant faculty on the designated research area

- An implication/ understanding PI will employ a specific technology or specific piece of background intellectual property in research

- Continuing approvals or inputs on recipients/designees over life of award

Note that contracting officers, when making determinations on whether funding falls under the category of a research gift or a sponsored award, consider all relevant details in each individual scenario. The list above is provided as general guidance but is not intended to serve as a definitive guide for all situations.

What are some common elements indicating that funding will likely be classified as a gift?

- Statements that the donor will not have any influence in the independent conduct of any studies or research, or in the dissemination of findings.

- Broad, less specific designations.

Note that contracting officers, when making determinations on whether funding falls under the category of a research gift or a sponsored award, consider all relevant details in each individual scenario. The list above is provided as general guidance but is not intended to serve as a definitive guide for all situations.

If a gift letter includes language around “open source software” or “public domain,” does that preclude the funding from being classified as a gift?

The contracting officer will review the details of the language to determine 1) if the requirement constitutes a direct benefit to the donor; 2) whether the requirement is consistent with our mission as a public university, and 3) if the language allows us to handle intellectual property in a manner consistent with our standard practices. Based on this analysis, the CO will provide guidance to all relevant parties on how the funding will be processed.

Can bug bounties be processed as gifts?

If the bug bounty is the individual work of a student or employee, and substantial GT resources were not involved, it is a gift to the individual and they are free to accept it. Bug bounties cannot be accepted by GTF as they represent funds received for a service performed. International students need to be aware that accepting such bounties as individuals could result in taxable income that may impact their visa status. Currently, we are examining what to do in situations where a bug bounty would be more appropriately directed to the Institute, as the language in these terms and conditions is often designed for an individual and would create problems if accepted at an organizational level.

Do research gifts have a period of performance?

The default period of performance for research gifts will be seven years from either the date the letter was issued, or if there is a mutually executed agreement, the date of last signature. The period of performance may be extended upon written request to the Contracting Officer at the end of the seven-year term. After the period of performance, unused gift funds will be accounted for as fixed-priced residuals.

Looking for something else?

- Go to Researcher Resources Index

- Have a question? Contact: evproffice@gatech.edu